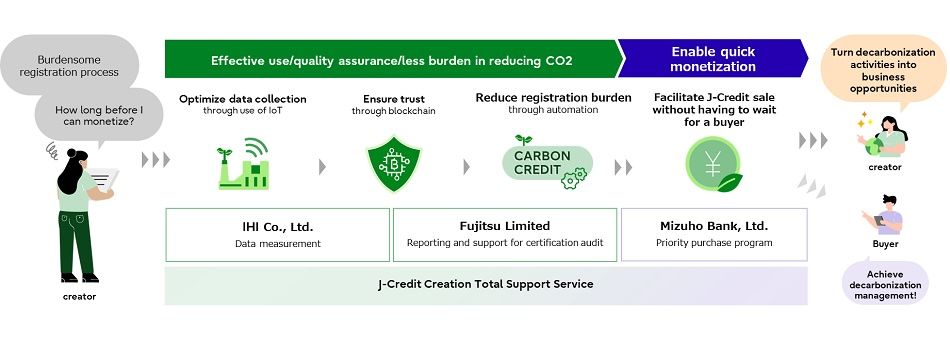

KAWASAKI, Japan, Sept 18, 2024 - (JCN Newswire) - IHI Corporation, Fujitsu Limited, and Mizuho Bank, Ltd. today announced that as of September 16, 2024, the three companies have entered into a memorandum of understanding regarding a joint business venture to provide the J-Credit (1) Creation Total Support Service. This service will optimize the J-Credit creation process in J-Credit scheme and support rapid monetization for J-Credit creators.

Currently, in order for companies and organizations to create J-Credits, various procedures are necessary across each of the phases, from project registration to J-Credit creation, and the significant time and effort required is an issue. In addition, there is an inherent risk that a buyer won’t be found after the credits are created, and that monetization will be delayed.

In order to tackle these issues, and increase J-Credit creation ahead of expected rising demand, this joint enterprise will combine the Mizuho Bank network with the MRV Support System (2), which digitizes the process of creating environmental value (i.e., measurement, reporting, and verification) and was developed by IHI and Fujitsu, to offer a total support service for J-Credit creators. In addition, in the first quarter of fiscal 2025, the effort aims to start providing J-Credits creation support for activities to reduce emissions through the introduction of photovoltaic power generation facilities to replace grid electricity.

The J-Credit Creation Total Support Service combines Fujitsu’s blockchain and automation technology with IHI’s knowledge regarding J-Credit creation and data collection engineering know-how to enable highly reliable data management and storage and reduce burden through automation of application procedures required for J-Credit creation. Moreover, through the J-Credit priority purchase program-which utilizes Mizuho Bank's customer network, the three companies provide a one-stop service.

The J-Credit Creation Total Support Service

IHI leverages its engineering and IoT capabilities to collect operational data on customer facilities, calculate CO2 reductions, and support the creation of environmental value including through the creation of J-Credits. By utilizing the environmental value management platform (3) and promoting further digitalization of the creation process, IHI will work to create a system that can create credible environmental value efficiently and further contribute to the realization of a decarbonized society.

Under the Fujitsu Uvance business model, which focuses on resolving societal issues, Fujitsu’s platform for the management of ESG, that supports the realization of corporate ESG management by visualizing, measuring, and optimizing CO2 reductions, uses AI to analyze ESG data, including data on CO2 emission reductions collected at the time of J-Credit creation and provides simulations needed for sophisticated management decision-making as well as recommendations. Through these measures, Fujitsu supports to acceleration of its customers sustainability transformation (SX.)

Mizuho Bank aims to facilitate decarbonization for its customers and society as a whole by playing an intermediary role for the emerging carbon credit market in its capacity as a financial institution. As the only financial institution designated as a “Best Market Maker” in the Tokyo Stock Exchange’s carbon credit market, Mizuho Bank is working to promote the liquidity and progress of the J-Credit market, and make contributions to both the environment and the economy.

Through this collaboration, the three companies seek to expand the J-Credit Creation market, accelerate decarbonization management and contribute to the creation of a sustainable society.

(1) J-Credit :Credits certified by the Japanese government for the amount of greenhouse gas emissions reduction or absorption.

(2) MRV Support System :A system that uses blockchain to improve the efficiency of operations such as monitoring, reporting, and verification of J-Credits. In FY2023 IHI and Fujitsu participated in a PoC related to digitization of credit certification utilizing the Ministry of the Environment’s "J-Credit Easy Generation" platform (now called the “MRV Support System”) and demonstrated the easy application for companies and other creators of environmental value through CO2 reduction activities. In FY 2024, the two companies were among those selected by the Ministry of the Economy to promote the digitization of MRV systems for J-Credit.

(3) The environmental value management platform :A digital platform for accumulating and commercializing data inside and outside the IHI Group as environmental value.

About IHI

IHI is a preeminent Japanese integrated heavy industry group that originated with the establishment of the nation’s first modern shipyard in 1853. It leveraged its shipbuilding technology to expand into onshore machinery, bridge, plant, aero-engine, and other manufacturing fields. IHI has provided an array of solutions in recent years. These are principally in the Resource, Energy and Environment; Social Infrastructure and Offshore Facilities; Industrial Systems and General-Purpose Machinery; and Aero Engine, Space and Defense business segments. In power generation, the Company manufactures boilers and gas turbines for thermal power plants. It is developing technology for ammonia firing and is constructing carbon-free fuel ammonia supply chain to help decarbonize the economy.

About Fujitsu

Fujitsu’s purpose is to make the world more sustainable by building trust in society through innovation. As the digital transformation partner of choice for customers in over 100 countries, our 124,000 employees work to resolve some of the greatest challenges facing humanity. Our range of services and solutions draw on five key technologies: Computing, Networks, AI, Data & Security, and Converging Technologies, which we bring together to deliver sustainability transformation. Fujitsu Limited (TSE:6702) reported consolidated revenues of 3.7 trillion yen (US$26 billion) for the fiscal year ended March 31, 2024 and remains the top digital services company in Japan by market share. Find out more: www.fujitsu.com.

About Mizuho

Mizuho Bank is a wholly-owned subsidiary of Mizuho Financial Group, Inc., one of the largest, full-service financial institutions in the world, with approximately 60,000 employees in 35 countries/regions outside of Japan, nearly 150 years of banking experience, and assets of almost USD 2 trillion. Mizuho Bank has one of the largest customer bases in Japan, and a global network of financial and business centers. At Mizuho, we will draw on our expertise as a financial services group to proactively provide financing support, including sustainable finance and environmental finance, as well as advice and solutions to strengthen and shift businesses towards decarbonization.

Press Contacts

Fujitsu Limited

Public and Investor Relations Division

Inquiries