|

Champion REIT Announces 2022 Annual Results

-- Overall operating environment continued to be impacted by the sluggish global economy and the severe fifth wave of COVID-19 in the first quarter

-- Langham Place Mall's sales outperformed overall Hong Kong retail market

-- Three Garden Road achieved BEAM Plus Platinum with Hong Kong's highest score

HONG KONG, Feb 24, 2023 - (ACN Newswire) - Champion Real Estate Investment Trust (stock code: 2778), the owner of Three Garden Road and Langham Place, announces its financial results for year ended 31 December 2022.

| | | |

| | (Left) Ms. Amy Luk, Investment and Investor Relations Director & (Right) Ms. Christina Hau, Chief Executive Officer | | |

| | Ms. Christina Hau, Chief Executive Officer | | |

Overview

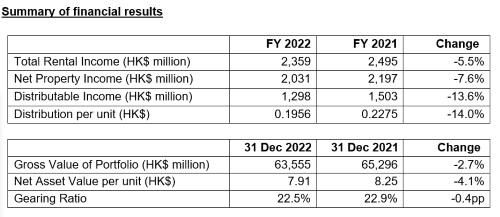

The local market sentiment gradually improved as COVID-19 moderated throughout the year. Nevertheless, the global economy in 2022 was marked by rising interest rates and inflation which dampened consumer sentiment and raised borrowing costs. The severe fifth wave of COVID-19 in the first quarter caused considerable interruptions for our tenants as well as the overall leasing momentum of our properties. Champion REIT recorded a drop in distributable income by 13.6% to HK$1,298 million and distribution per unit ("DPU") declined 14.0% to HK$0.1956.

Three Garden Road

Three Garden Road recorded a shrank of the rental income by 7.8% to HK$1,346 million in 2022 (2021: HK$1,460 million). Occupancy of Three Garden Road was 82.7% as at 31 December 2022 due to downsizing and relocation of tenants in the financial industry.

Langham Place Office Tower

Total rental income of the property was relatively stable at HK$363 million (2021: HK$365 million). Occupancy of the property was 93.3% as at 31 December 2022. Lifestyle tenants remained a mainstay among the new occupiers, accounting for 71% as at 31 December 2022.

Langham Place Mall

Full year tenants' sales went up 8%, outperforming the overall Hong Kong retail sales which dropped by 0.9% in 2022. The beauty segment recorded an encouraging growth, contributing to a 210.4% increase in turnover rent portion to HK$117 million. The total rental income of the property went down 3.1% to HK$650 million (2021: HK$670 million). The mall remained fully occupied as at 31 December 2022.

Distribution

Distributable income of the Trust dropped 13.6% to HK$1,298 million (2021: HK$1,503 million) and DPU dropped 14.0% to HK$0.1956 (2021: HK$0.2275). Based on the closing unit price of HK$3.08 recorded as at 30 December 2022, the total DPU represented a distribution yield of 6.4%.

Asset Value

The appraised value of the Trust's property portfolio was HK$63.6 billion as at 31 December 2022, declining 2.7% from HK$65.3 billion as at 31 December 2021.

Sustainability

While making a stable progress in our 2030 Environmental, Social and Governance ("ESG") targets, the establishment of the 2045 Net Zero roadmap further reinforces our decarbonisation commitments. Besides the first existing building in Hong Kong to achieve the WELL Building Platinum Standard, our ongoing decarbonisation advancement and green innovation enable Three Garden Road to attain its "Double Platinum" honour along with the Platinum certification of BEAM Plus Existing Building with Hong Kong's highest score. We also launched a series of activities circled on the "Love . Play . Farm" project to achieve both green and social sustainable impacts.

Outlook

The gradual relaxation of COVID-19 measures for residents and visitors in Hong Kong, as well as the border reopening with mainland China should benefit the local economy. Overall, 2023 remains a challenging year for the Trust in view of potential global economy recession despite the fact that mainland China's reopening is expected to reinvigorate the retail and potentially office markets.

Looking forward, we will continue to take a prudent approach on liability management and treasury management to identify yield enhancing opportunities. For potential acquisitions, we will continue to take an opportunistic and conservative approach. We will continue to monitor the market conditions, and capture business opportunities to enhance the performance of the Trust, and collaborate closely with tenants and stakeholders on our sustainability journey.

About Champion REIT (stock code: 2778)

Champion Real Estate Investment Trust is a trust formed to own and invest in income producing office and retail properties. The Trust focuses on Grade A commercial properties in prime locations. It currently offers investors direct exposure to nearly 3 million sq. ft. of prime office and retail floor area. These include two Hong Kong landmark properties, Three Garden Road and Langham Place, as well as a joint venture stake in 66 Shoe Lane in Central London. Since 2015, the Trust has been included in the Constituent of Hang Seng Corporate Sustainability Benchmark Index of Hang Seng Indexes.

Website: www.championreit.com

Source: Champion REIT

Sectors: Real Estate & REIT

Copyright ©2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network. |

Latest Press Release

MHI Group Issues its "SUSTAINABILITY DATABOOK 2024"

Dec 13, 2024 16:31 JST

|

Notification of Dissolution of Joint Management of LT Metal Co., Ltd. by TANAKA Kikinzoku Kogyo K.K. and LT Corp.

Dec 13, 2024 04:00 JST

|

MHI's Automated Picking Solution Utilizing Sigma Synx Fully Implemented at Kirin Group's Ebina Logistics Center, the First Such System in Japan

Dec 12, 2024 16:47 JST

|

NEC Announces Interim Results from Phase 1 Clinical Trial of NECVAX-NEO1, an AI-Driven Personalized Oral Cancer Vaccine, at ESMO Immuno-Oncology Congress 2024

Dec 12, 2024 16:27 JST

|

JCB, AEON Credit Service Indonesia, and Biznet, Indonesia's Leading Internet Provider, Launching AEON Biznet JCB Precious Card, Co-Brand Card

Dec 12, 2024 12:00 JST

|

JCB to Enable Seamless Transactions on ETA Applications for UK-Bound Travellers

Dec 12, 2024 12:00 JST

|

Fujitsu develops video analytics AI agent to support safe, secure, and efficient frontline workplaces

Dec 12, 2024 11:06 JST

|

Fujitsu develops world's first multi-AI agent security technology to protect against vulnerabilities and new threats

Dec 12, 2024 10:28 JST

|

Intelligent Joy Limited Signs MOU for Strategic Cooperation with First U.S. Capital Group

Dec 11, 2024 19:30 JST

|

Fujitsu concludes share transfer agreement concerning Fujitsu Communication Services Limited

Dec 11, 2024 16:36 JST

|

Eisai's "URECE(R)" (Dotinurad) Approved in China for Gout Patients with Hyperuricemia

Dec 11, 2024 14:45 JST

|

CELH Class Action Reminder: Kessler Topaz Meltzer & Check, LLP Reminds Celsius Holdings, Inc. Investors of Securities Fraud Class Action Lawsuit Deadline

Dec 11, 2024 10:19 JST

|

Kessler Topaz Meltzer & Check, LLP Reminds Investors of Deadline for Securities Fraud Class Action Lawsuit Filed Against Wolfspeed, Inc.

Dec 11, 2024 10:15 JST

|

Combating customer harassment: Fujitsu, Toyo University and Kokoro Balance Research Institute launch field trial on AI-powered training program

Dec 11, 2024 10:11 JST

|

PACS Group, Inc. Investors: January 13, 2025 Filing Deadline in Securities Class Action - Contact Kessler Topaz Meltzer & Check, LLP

Dec 11, 2024 10:10 JST

|

Acadia Healthcare Company, Inc. (ACHC) Investors: December 16, 2024 Filing Deadline in Securities Class Action - Contact Kessler Topaz Meltzer & Check, LLP

Dec 11, 2024 10:05 JST

|

Provision of the First Template Function Adapted to the IFRS Sustainability Disclosure Standards in Japan (IFRS S1 and S2) on the Sustainable Finance Platform

Dec 10, 2024 19:16 JST

|

Fujitsu drives business process improvement at Mitsubishi Electric Engineering using SAP Signavio(R)

Dec 10, 2024 11:38 JST

|

HAIN Premieres December 13, Showcasing the Power of Turkish Cinema

Dec 09, 2024 23:00 JST

|

Fourteen new trains to drive first rail open access growth

Dec 09, 2024 20:10 JST

|

More Latest Release >>

|